Semih Korkmaz

Semih KorkmazSerbest Muhasebeci Mali Müşavir

semihkorkmaz@gmail.com

Participation Fee For Recycling

The declaration date of the participation fee for recycling is so close for 2020 January, but there are still so many question marks in the minds of taxpayers. My goal is to summarize the last regulation for the expats in Turkey regarding the participation fee for recycling (of the packages).

The regulation has been updated about participation fee for recycling of the products which listed in the Environment Law (List Nr.1). During 2019, the regulation was for only the pochettes (nylon bag) and the stores (selling points) were responsibles to pay the participation fee. (For per pochette, the fee was 0,15 TL for responsibles but reflected as 0,25 TL to the last consumer for each)

According to the first communique, the fee for other products would begin with 2020 January. With additional communiques, some parts have been changed but not the beginning date, so 2020 January Declaration is supposed to be represented to tax office until 29th February 2020. Since it is a holiday, 2th March is last day for 2020/January declaration. (The last day was 24th day of the following month but it has been extended to the last day with last regulation.) Payment must be also done within the same period.

Also there is another change for the deduction of participation fee calculated from the products which have been returned to responsible after selling. This deduction was only possible after the approval of the related administration officers according to the previous communique but it’s been changed too. Deduction is possible in the declaration now.

Market Distributors and stores are responsibles for this regulation and they also need to prepare the declaration and represent it to tax office via online declaration system. (Corporate taxpayers will provide the declaration monthly while the others quarterly)

► Market Distributor: It means the company who ensures the circulation of a product in the list into the domestic market. In this case, for import; importers are market distributors (import other than free circulation method such as inward process are beyond this regulation) and for selling a product in domestic market; first seller will be the market distributor. (Exporters are not market distributors)

► Stores (Selling point): Stores are the places like markets and stores; where the goods are sold via wholesale or retail methods. These are responsibles for the pochettes they give to buyers, as well as they are responsible as market distributor for the products in the list below like the other market distributors.

►Environment Officer: For the market distributors and stores, environment officer is responsible for dedecting the products in the list for the participation fee, ensuring the calculation of the amount by accounting responsible. They are also responsible for the declaration to provide, control, monitor and report as arranged in the regulation.

►Accounting Responsible: These are accounting responsibles of Market Distributors/Importers/Stores who make the general bookings and maintain the general accounting process of the taxpayers above. Market Distributors and stores have to make their declarations and calculations approved by the Accounting Responsibles.

The responsibles which hire environment officer or get environment management service or have to establish environment management unit or whose monthly participation fee is more than 50.000,00 TL are supposed their declarations to be approved by Accounting Responsible and Environment Officer.

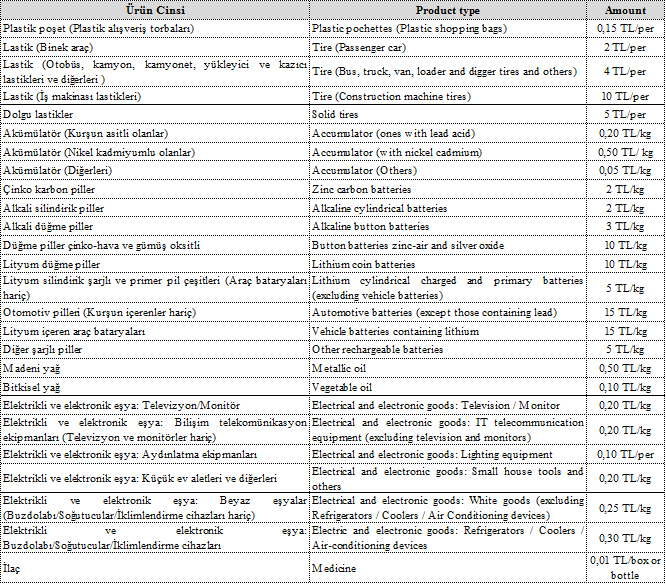

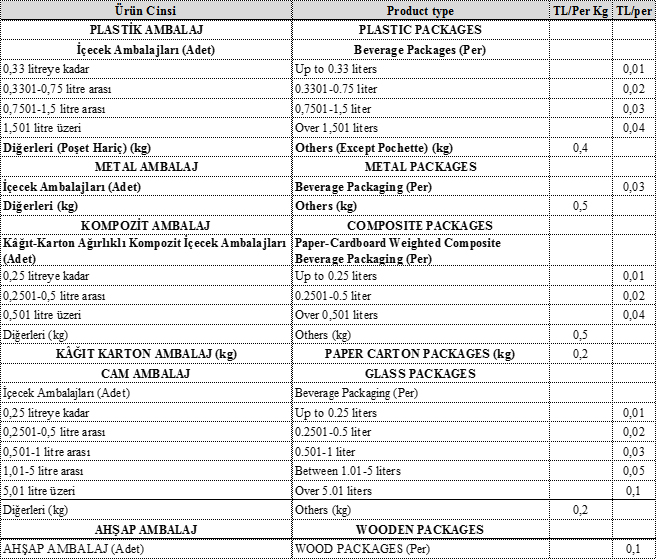

► The List in the regulation called Nr:1 is as below:

► Some examples regarding the regulation:

Example 1) A package manufacturer (company A) sells 1000 kg paper packages to Company B. For this product, there is 10 kg paper package around the papers. Company B sells yarn while using that 1000 kg paper packages to Company C.

In this case: For 10 kg package; Company A is Market distributor and responsible for declaration. For 1000 kg paper; Company B is Market Distributor and responsible. There will be no additional participation fee for these packages for the further usage of them in the market. So, Company C is not responsible for 1000 kg paper.

Example 2) Company A imports raw material and there are some wooden pallets, nylon, metal and composit packages with the product.

In this case: For all this packages including wooden pallet, Company A is market distributor and will be responsible. The fees will be calculated differently as specified in the List. There will be no additional participation for these packages for the further usage of them in the market. The import date will be also the responsibility date for the importer.

►There are some products (they are not packages) in the list like metallic oil. For these products, the fee will be calculated from the product’s amount (kg or ea), and not from its first package, but the fee will also be calculated from seconder and third packages. The fee is calculated from the net weight of the product.

Example 3) Metallic oil is in the list. If a company import 10 barrels of metallic oil in a nylon package and on a pallet; for barrels, the company will not be responsible since they are first packages; but will be responsible for metallic oil, nylon package and pallet package.

Example 4) Company A imports 500 kg vetegable oil via inward process. In this case Company A is not responsible as specified in the regulation.

Seemingly so many possible responsible does not know about this regulation yet, especially small businesses. It may also hard for them to make the calculations properly due to their lacking staff and workload. Taxpayers need to be careful regarding this regulation. according to the law, the penalty can be multiplied by %120 of the fee, and the interest will also be collected.

References

[1] Environment Law numbered 2872.

[2] Participation Fee Communique, regulation and guide.

28.02.2020

Kaynak: www.MuhasebeTR.com

(Bu makale kaynak göstermeden yayınlanamaz. Kaynak gösterilse dahi, makale aktif link verilerek yayınlanabilir. Kaynak göstermeden ve aktif link vermeden yayınlayanlar hakkında yasal işlem yapılacaktır.)

>> Duyurulardan haberdar olmak için E-Posta Listemize kayıt olun.

>> SGK Teşvikleri (150 Sayfa) Ücretsiz E-Kitap: hemen indir.

>> MuhasebeTR mobil uygulamasını Apple Store 'dan hemen indir.

>> MuhasebeTR mobil uygulamasını Google Play 'den hemen indir.

>> YILIN KAMPANYASI: Muhasebecilere Özel Web Sitesi 1.249 TL + KDV Ayrıntılar için tıklayın.

Vergi Başmüfettişi Ahmet Turgut Akkaya

Vergi Başmüfettişi Ahmet Turgut Akkaya

VERGİ VE MUHASEBE CEZALARINDAN KORUNMA YOLLARI KİTABI

VERGİ VE MUHASEBE CEZALARINDAN KORUNMA YOLLARI KİTABI Asgari Ücret 2025 - Asgari Ücret Ne Kadar?

Asgari Ücret 2025 - Asgari Ücret Ne Kadar?

Vergi Dilimleri 2025

Vergi Dilimleri 2025

30.06.2025 Tarihi İtibari İle Uygulanacak Yabancı Para Değerleri

30.06.2025 Tarihi İtibari İle Uygulanacak Yabancı Para Değerleri

Kıdem Tazminatı Hesabında Dikkate Alınacak Ödemeler

Kıdem Tazminatı Hesabında Dikkate Alınacak Ödemeler

15 Soruda Yıllık İzin Uygulaması

15 Soruda Yıllık İzin Uygulaması

Gönüllü Uyum

Gönüllü Uyum

Turizm Belgeli Otellerde Çalışanların Hafta Tatilleri

Turizm Belgeli Otellerde Çalışanların Hafta Tatilleri

Turizm Esnek Hafta Tatili

Turizm Esnek Hafta Tatili

Şirket Birleşmeleri ve Dikkat Edilmesi Gereken Hususlar

Şirket Birleşmeleri ve Dikkat Edilmesi Gereken Hususlar

Yeşil Dönüşüm Liderleri Ve Yatırım Teşvikleri

Yeşil Dönüşüm Liderleri Ve Yatırım Teşvikleri

Yılın Kampanyası: Muhasebecilere Özel Web Sitesi 1.249 TL + KDV

Yılın Kampanyası: Muhasebecilere Özel Web Sitesi 1.249 TL + KDV